Key Takeaways:

- Major labels are shifting from suing AI music generators Suno and Udio to seeking licensing deals and equity stakes

- Future artist contracts will need to address AI-generated content and synthetic likeness rights

- The real power in music may shift from labels to whoever controls the AI models and platforms

Music labels are switching from lawsuits against AI music generators Suno and Udio to cutting deals with them instead.

Universal Music Group, Warner Music Group, and Sony Music Entertainment are reportedly in licensing talks with controversial AI platforms Udio and Suno, marking a potential turning point in how the industry approaches artificial intelligence.

The discussions, revealed by Bloomberg on Sunday, involve the labels seeking both licensing fees and equity stakes in the AI companies. This represents a dramatic change from just under a year ago when these same companies filed copyright infringement lawsuits against Suno and Udio, seeking damages of up to $150,000 per allegedly infringed work.

From Legal Battles to Business Partnerships

The lawsuits, filed in June 2024 by the RIAA (Recording Industry Association of America) on behalf of the major labels, accused Suno and Udio of training their AI systems on copyrighted recordings without permission. Both companies essentially admitted to this practice in court filings last August, though they argued their use fell under “fair use” exemptions.

The AI platforms allow users to generate complete songs from simple text prompts, such as “a modern country ballad about unrequited love”. This technology has created music that bears striking similarities to works by established artists including The Temptations, Green Day, and Mariah Carey. Suno continues to evolve its capabilities with the latest Suno v4.5 update, making the platform increasingly sophisticated.

Complex Negotiations Ahead

The reported talks face significant challenges. Music companies want greater control over how their catalogs are used, while the AI startups seek flexibility to experiment and reasonable pricing for their startup budgets. Sources told Bloomberg the discussions could still collapse, highlighting the delicate nature of these negotiations.

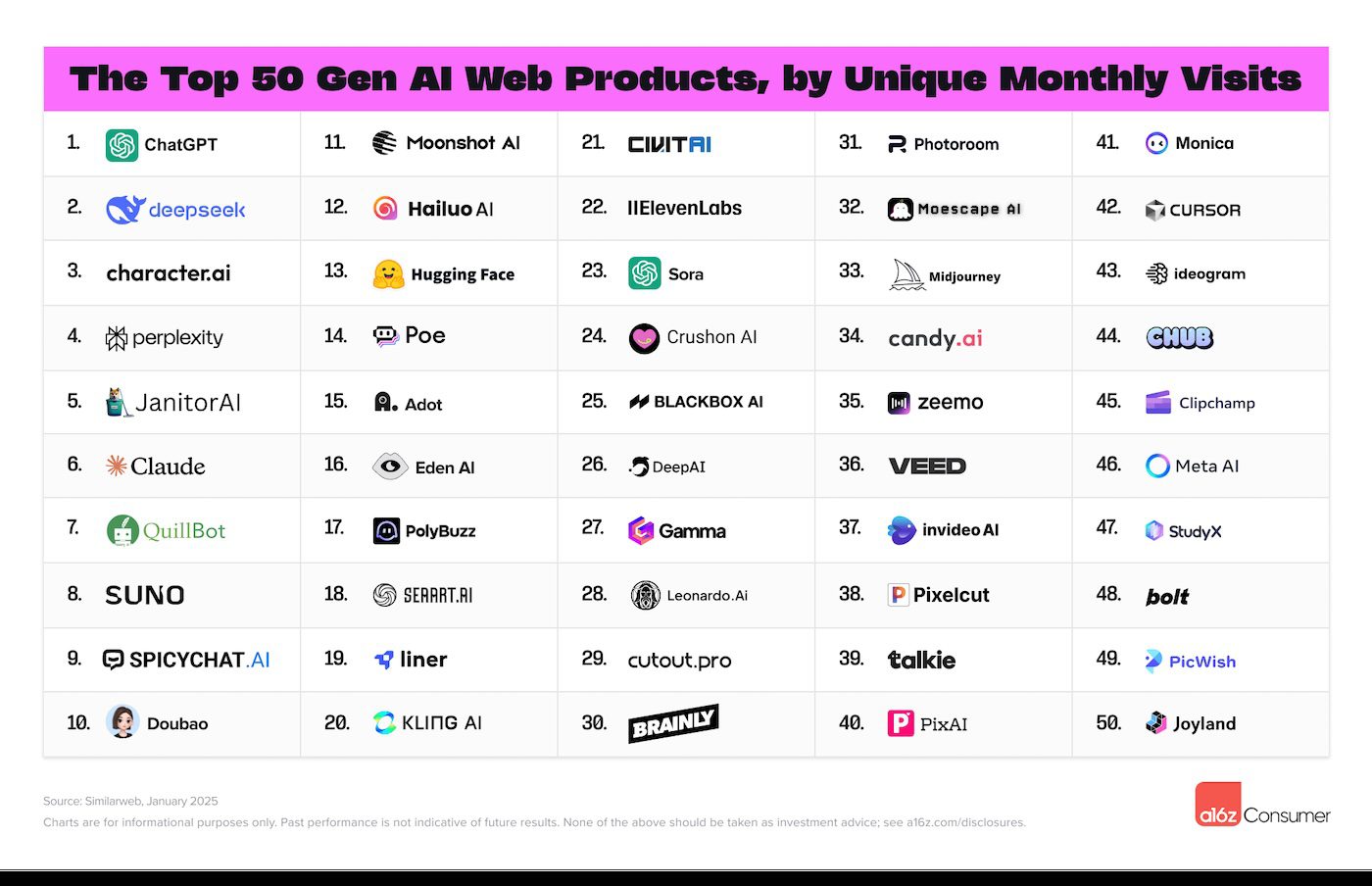

Suno, valued at $500 million after it raised $125 million last year, and Udio, which secured $10 million led by Andreessen Horowitz, represent significant investments in AI music technology despite ongoing legal uncertainties. The platform’s popularity has grown substantially, ranking as the 8th most popular generative AI tool according to recent industry reports.

Imagecredit: Andreessen Horowitz

Imagecredit: Andreessen Horowitz

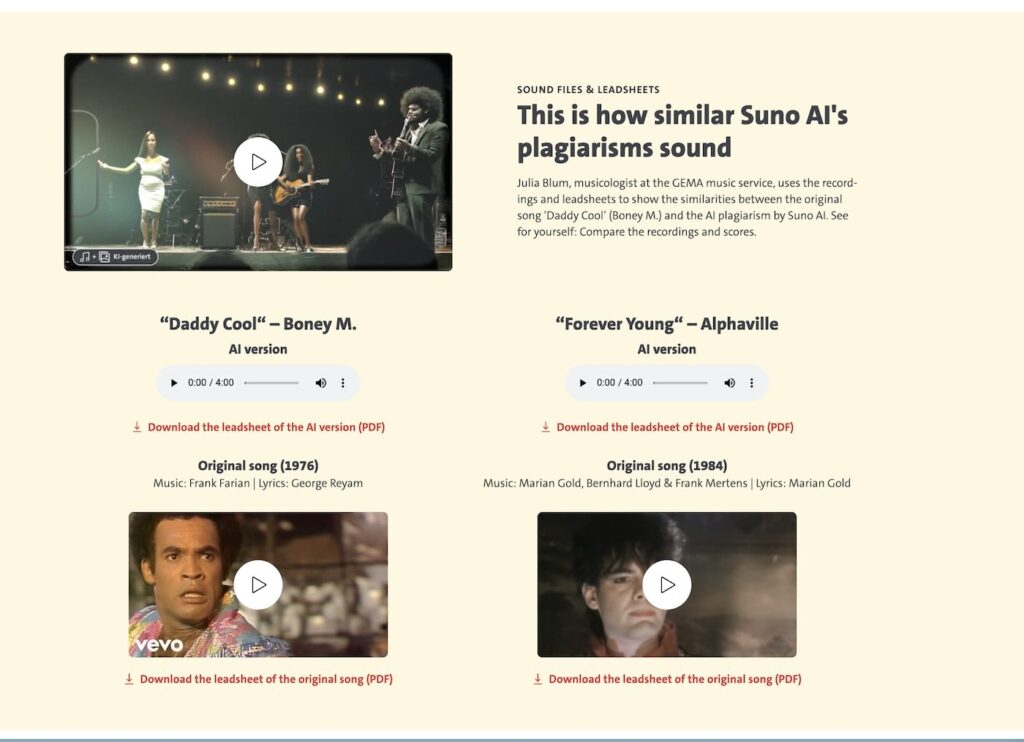

However, legal challenges persist. Suno faces a separate GEMA lawsuit in Germany, where the collection society accused the platform of generating content nearly identical to protected works including “Mambo No. 5” and other classics.

Screenshot

Screenshot

The Future of Music Creation

These negotiations signal broader transformations coming to the music industry. AI-native music catalogs are emerging, where entire label rosters could consist of virtual artists creating and releasing music autonomously. The question won’t be whether the music is “real,” but whether it charts and connects with audiences.

Artist contracts will fundamentally change to include “synthetic likeness” clauses, determining who owns an artist’s AI twin and how royalties from AI-generated remixes are split. Labels will monetize both the human artist and their digital model, requiring creators to understand these new revenue streams.

Perhaps most significantly, the traditional gatekeepers may be shifting. As AI tools become dominant, the most powerful players might not be music companies but the platforms building and owning the models themselves. We could see TikTok launching AI music studios, Spotify creating track generators trained on user playlists, or new platforms emerging specifically for AI-assisted songwriting.

Despite the legal uncertainties, major tech companies continue partnering with AI music platforms. Amazon’s Alexa integration with Suno demonstrates how mainstream adoption continues even amid copyright disputes.

Learning from History

This moment echoes the industry’s initial resistance to MP3s and digital music. The labels didn’t win by blocking technological change—they succeeded by eventually embracing and owning it. The current licensing talks suggest the industry is choosing adaptation over litigation, recognizing that controlling AI music technology may be more valuable than fighting it.

Major labels flip from suing AI music platforms to seeking deals. Get licensing fees and equity stakes. Transform music creation forever. → Read the full story!