Spotify claims its AI deals will benefit artists. Here’s what the shareholder deck actually reveals about payouts, profits, and the platform’s AI-powered future.

Spotify Co-CEO Gustav Söderström made a bold promise during the Q4 2025 earnings call: “”We will not do deals that aren’t good for artists.”” This statement came as the company prepares to launch AI tools letting fans generate remixes and covers of licensed music.

The Spotify Q4 Shareholder Deck reveals a company transforming from streaming service to AI creation hub. Here are 5 things that help you understand what this shift means for your music career.

Jump Links

5 Revelations Shaping Artist Strategy in 2026

These findings come directly from Spotify’s SEC filings and earnings call. Each point carries implications for how you license, distribute, and monetize your work.

1. Spotify Paid $11 Billion to Music Industry in 2025

This is the largest annual payment to music creators from any single retailer in history.

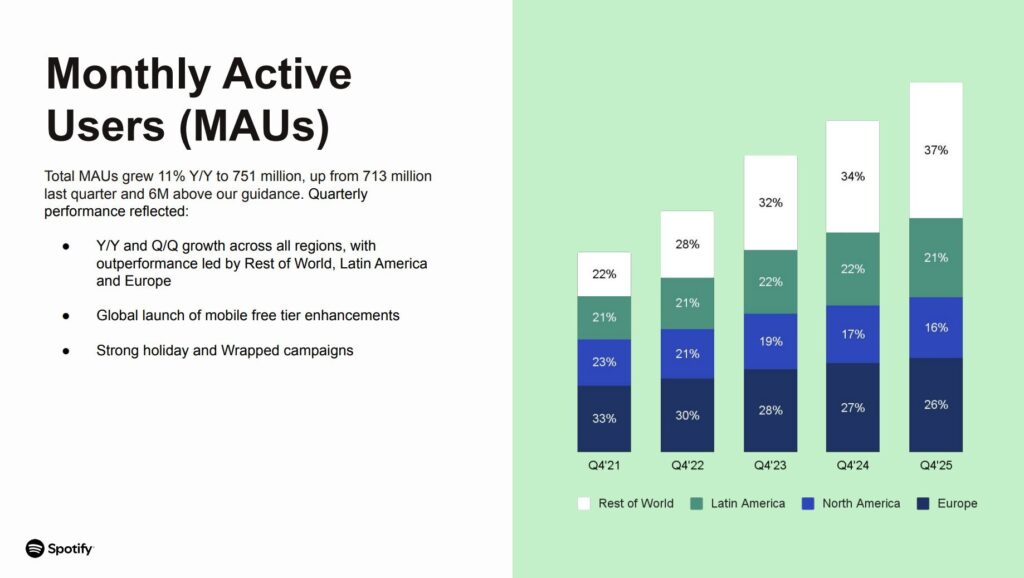

The platform now reaches 751 million Monthly Active Users and 290 million Premium Subscribers. That scale drives the massive payout figure Spotify uses to justify its artist-first AI music tools partnership with major labels.

Source: Spotify Q4 2025 Shareholders Deck

Source: Spotify Q4 2025 Shareholders Deck

What this means for your revenue:

- Pro-rata payouts still favor high-stream artists

- Independent artists compete against an expanding catalog

- The per-stream rate remains under pressure despite total payout growth

The $11 billion figure sounds impressive until you examine distribution. Most flows to major label AI licensing deals and top-tier catalog owners.

Spotify is building a “licensed sandbox” for fan-made remixes and covers inside its platform.

The company positions itself as the “R&D department for the music industry.” This mirrors YouTube’s Content ID strategy from the 2010s. Instead of fighting user-generated AI content, Spotify wants to monetize it through the NMPA licensing agreement framework.

The economic model shifts unit economics:

- AI features locked behind potential “Superfan” premium tier

- Extra $5/month subscription drives ARPU without raising licensing costs

- Unique revenue splits for fan-made derivatives

For publishers and songwriters, tracking AI-generated compositions for mechanical payouts requires entirely new data infrastructure. Sony Music has already demanded licensing agreements from 700+ AI companies to address this complexity.

3. Record Profits Signal Spotify’s Strategic Pivot

Source: Spotify Q4 Shareholders Deck

Source: Spotify Q4 Shareholders Deck

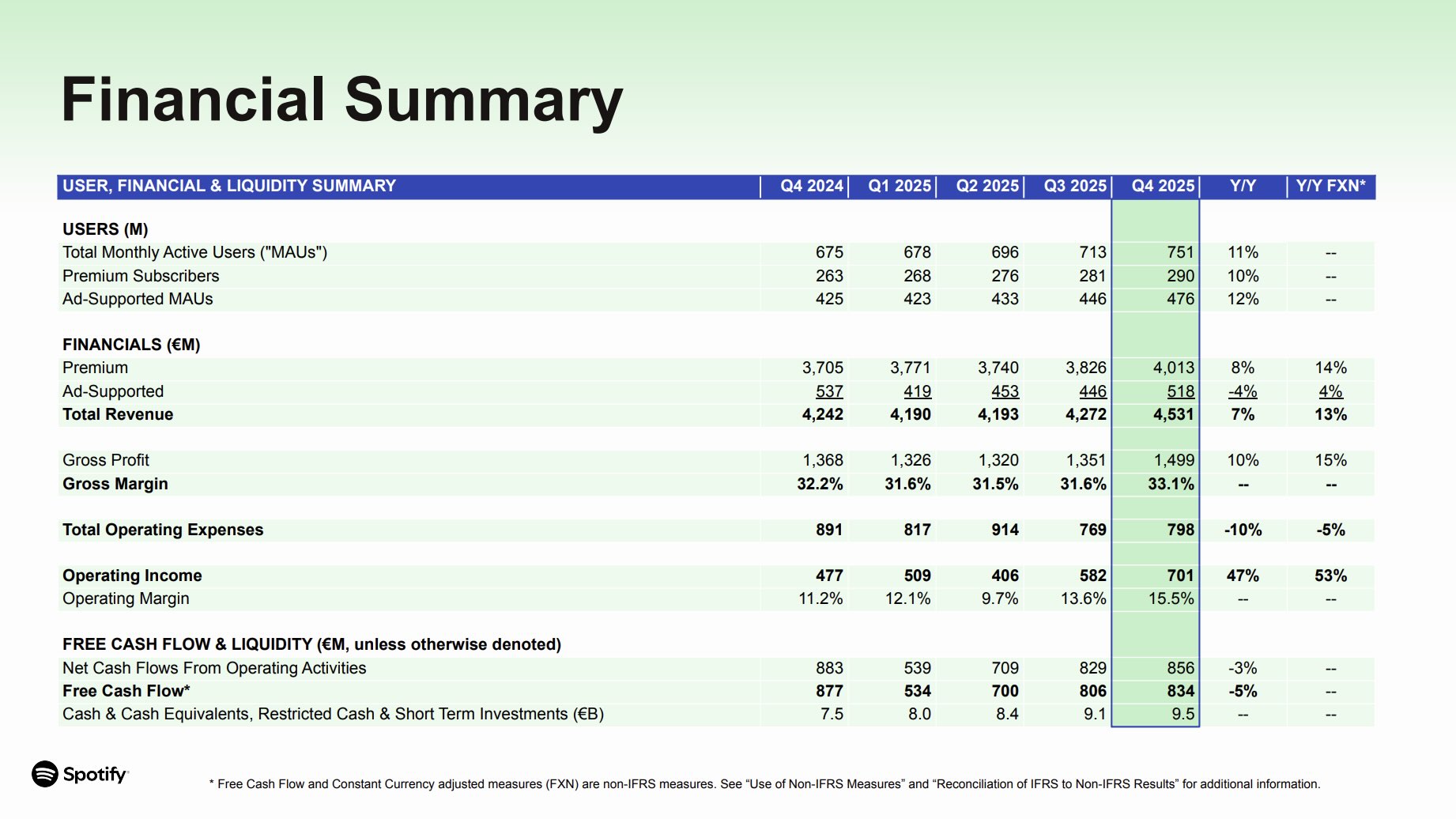

Q4 2025 delivered €701 million in Operating Income with a 33.1% Gross Margin.

Spotify generated €2.9 billion in Free Cash Flow for the year. Total Revenue grew 13% year-over-year to €4.53 billion. Premium Gross Margin reached 34.8%.

The company abandoned “”growth-at-all-costs”” for sustainable profitability. This matters because margin expansion now depends on new revenue sources like AI tools rather than traditional streaming growth.

4. Spotify Lists AI as Official Risk Factor

Behind optimistic earnings calls, SEC filings tell a different story.

The company explicitly names “use of artificial intelligence” alongside privacy and content moderation as ongoing operational risks.

Spotify’s AI policy roadmap targets AI-generated soundalikes through metadata standards. The RIAA AI licensing principles provide industry guidance, but enforcement remains untested.

5. “Good for Artists” Means Good for Top Rights Holders

When Spotify promises artist-friendly AI deals, examine who benefits.

The uncomfortable truth: “good for artist” typically means good for major labels and top-tier rights holders. Superstars gain passive revenue as their voice and stems become licensed software instruments. Fans remix, labels collect micro-royalties.

The risks for working musicians:

- Emerging artists face higher noise floors as fans create endless variations of established hits

- Traditional remix economy faces existential pressure

- Listener attention shifts toward AI-generated content, away from new artist discovery

Beatoven’s AI licensing model demonstrates alternative approaches through direct artist partnerships. Update your contracts now to define how your voice and stems get used in AI derivatives.

Quick Recap

- $11 billion payout sounds massive but distribution favors top catalog owners

- AI derivative tools create new revenue streams locked behind premium tiers

- Record profitability drives Spotify toward AI features over traditional streaming

- SEC filings acknowledge AI as operational risk despite public optimism

- “Artist-friendly” deals primarily benefit established rights holders

Which of these findings changes how you’ll approach your next release?”